The Advantages of Home Buying In Today's Market

For every article you find on the internet that says, it’s time to buy a home, you will find one that says to wait. As it stands, consumers are proving they are ready to be homeowners. It might be the stay-at-home orders that has created a surge of eager buyers or the market instability providing dropping mortgage rates but either way, home shoppers are in the market. Mortgage applications to purchase a home rose 5% for the week and were a remarkable 33% higher than a year ago, according to the Mortgage Bankers Association’s index.

At People’s Choice Mortgage our prime responsibility is to educate our clients so you can truly make the best choice for your home loan process. There are a number of financial options and reasons why now is an extremely affordable time to buy a home.

The three main factors that go into determining how affordable homes are for buyers:

Mortgage Rates

Mortgage Payments as a Percentage of Income

Home Prices

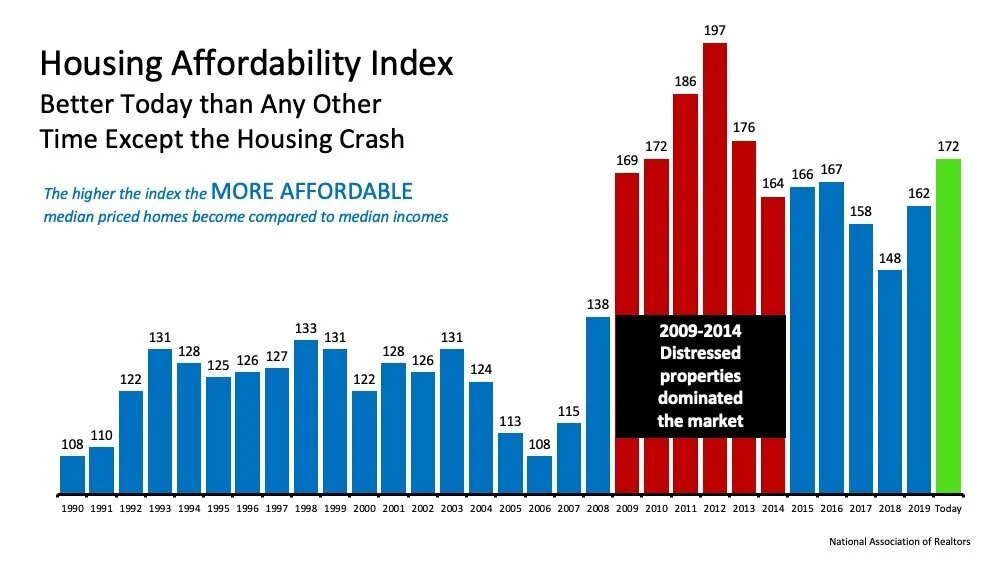

The National Association of Realtors (NAR), produces a Housing Affordability Index, which takes these three factors into account and determines an overall affordability score for housing. Unlike previous market crashes we are recovering faster. Also there are significantly more buyers than sellers, so the prices of homes are still increasing due to limited inventory. This may change over time if there does happen to be an uptick in foreclosures and shortsales due to the homes in forbearance. However, the U.S. mortgage forbearance rate fell to 8.39% in the last week of June, down from 8.47% a week earlier. As businesses continue to reopen and the jobs market improves, it’s still a guessing game on if things will go south for housing inventory and we’ll see a home price drop.

The green bar represents today’s affordability.

What Makes Home Buying Affordable Today?

Of the three factors that drive the overall equation, the one that’s playing the largest part in today’s home buying affordability is historically low mortgage rates. Based on this primary factor, we can see that it is more affordable to buy a home today than at any time in the last seven years.

As a consumer it’s important to understand the value of interest rates. Most people understand credit cards have a higher than usual interest rates so it’s important to pay it off quickly to avoid lofty fees. Home loans can quickly be changed by thousands to hundreds of thousands by % drops in interest rates.

If you were to apply for a 30-year home loan at $365,000 and qualify for a 5% interest rate the average loan could potentially have a monthly mortgage payment of $1959 but you would also pay up to $518,000 in interest and additional fees over the lifetime of the loan. However, if you drop the interest rate down to 3% you may only be facing up to $359,000 interest fees with a possible monthly mortgage payment of $1538 saving yourself both in the long term and short term of your loan. These numbers vary based on credit, loan type and other factors of course which is why it’s crucial to have an adept loan officer on your side.

Informed consumers understand the affordability associated with low interest rates. Considering all of your buying options while mortgage rates are as low as they are now could save you quite a bit of money over the life of your home loan.

Final Considerations

If you feel ready to purchase a home, this might be the most opportune time for you to do so. The only guaranteed way to see what advantages this time has for you, is to speak with our loan officers and get educated on your loan options today. Feel free to walk yourself through our home purchase qualifier and a loan officer will be in touch shortly to go over your specific loan loan options based on your qualifications.